AtlasX Case Studies

Empowering our customers to build a data-driven real estate investment business.

request a demo Greystar: Enhanced Reporting and Knowledge Sharing

Greystar: Enhanced Reporting and Knowledge Sharing Case Study

Case StudyEstablished in 1993, Greystar is a vertically integrated firm that makes investments across a range of strategies and asset classes, as well as being the largest property management company in the U.S. With $23.5B in Equity Under Management, Greystar has presence in 161 US markets and 17 countries.

Learn more SpareBox: Managing Industry Leading Growth With AtlasX

SpareBox: Managing Industry Leading Growth With AtlasX Case Study

Case StudySpareBox Storage, founded in August 2020, acquires and manages stabilized self-storage properties throughout the United States. With over 100+ locations, SpareBox is one of the fastest growing self-storage operators in the U.S.

Learn more Faropoint: Creating a Broker Network Within AtlasX

Faropoint: Creating a Broker Network Within AtlasX Case Study

Case StudyFaropoint is a real estate investment firm focused on last-mile industrial buildings founded in 2012 and 20M+ Sq. Ft. owned.

Learn more Wheelock Street Capital: Tracking Fund Metrics With AtlasX

Wheelock Street Capital: Tracking Fund Metrics With AtlasX Case Study

Case StudyEstablished in 2008, Wheelock Street Capital is a private equity real estate firm that invests in residential land, multifamily, industrial, office, and retail. With broad internal experience and flexible capital, Wheelock has successfully deployed $8B in total value on behalf of institutional LPs.

Learn more Abacus: Building Competitive Intelligence With Deal Management

Abacus: Building Competitive Intelligence With Deal Management Case Study

Case StudyAbacus Capital, founded in 2004, is a multifamily private equity fund and developer with over $4.8B invested.

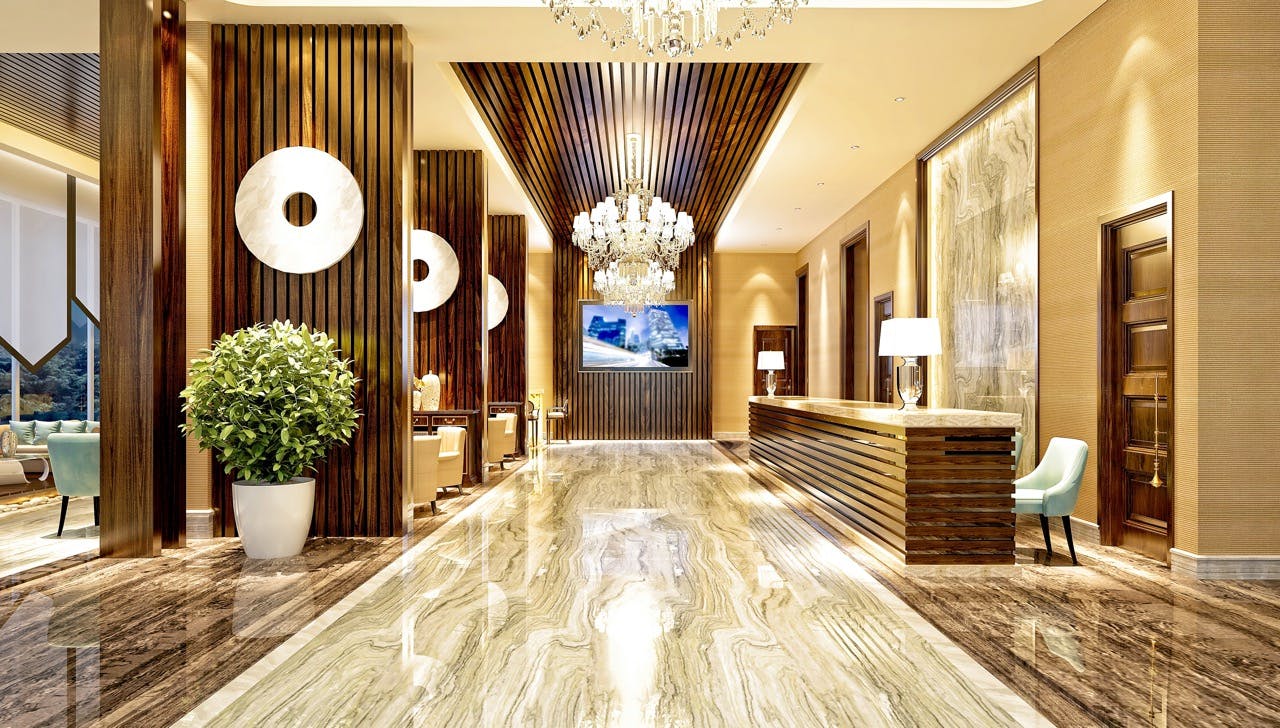

Learn more KHP: Building Teamwide Pipeline Efficiency With AtlasX

KHP: Building Teamwide Pipeline Efficiency With AtlasX  Case Study

Case StudyFormed in 2015, KHP is the former private equity business managed by Kimpton Hotels & Restaurants. KHP has invested $1.25B of equity capital across 6 private equity funds, focusing on the boutique and independent lodging sectors.

Learn more